gilti high tax exception tested unit

9902 under sections 951A and 954 and. 5471 may require inclusion of the same information.

Gilti Of Putting All Of Your Taxes In One Basket

15 The 2020 proposed regulations apply a more.

. New Jersey Property Tax Exemption for Renewable Energy Systems. Those rules are much. Like the GILTI high-tax exclusion the 2020 proposed regulations provide that the Subpart F high-tax exception applies on a tested unit basis.

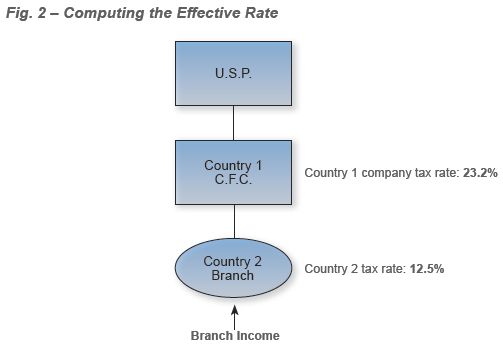

6 Note under the current Subpart F high-tax exception the effective tax rate is determined at the CFC level separately for separate items of Subpart F income. Depending on the company that owns the antenna the tax may be assessed by the state or a municipality. Some of the highlights of the final regulations include.

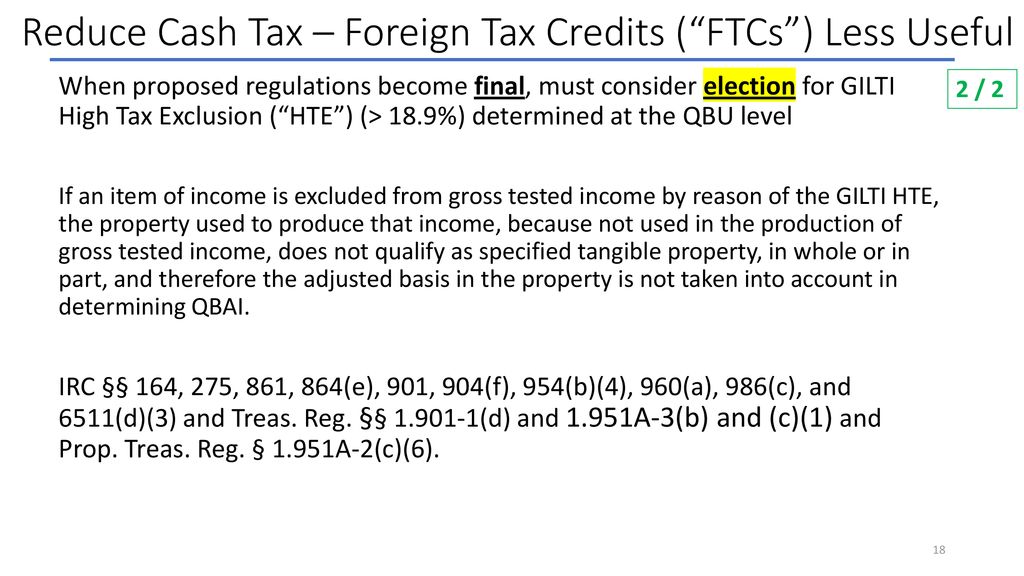

West Windsor Township NJ the New Jersey Superior Court Appellate Division ruled that a not-for. By subscribing to future McDermott updates you are agreeing to allow us to. The effective foreign tax rate for purposes of the high-tax exclusion is calculated on a tested-unit basis.

Under the 2020 Final Regulations a new tested unit approach has replaced the QBU approach taken by the 2019 Proposed Regulations such that CFC income items qualify. Here are the programs that can. Taxation interpreting the application of the subject-to-tax and unreasonable exceptions to New Jerseys Corporate Business Tax CBT related-party add-back statute1 In Morgan Stanley.

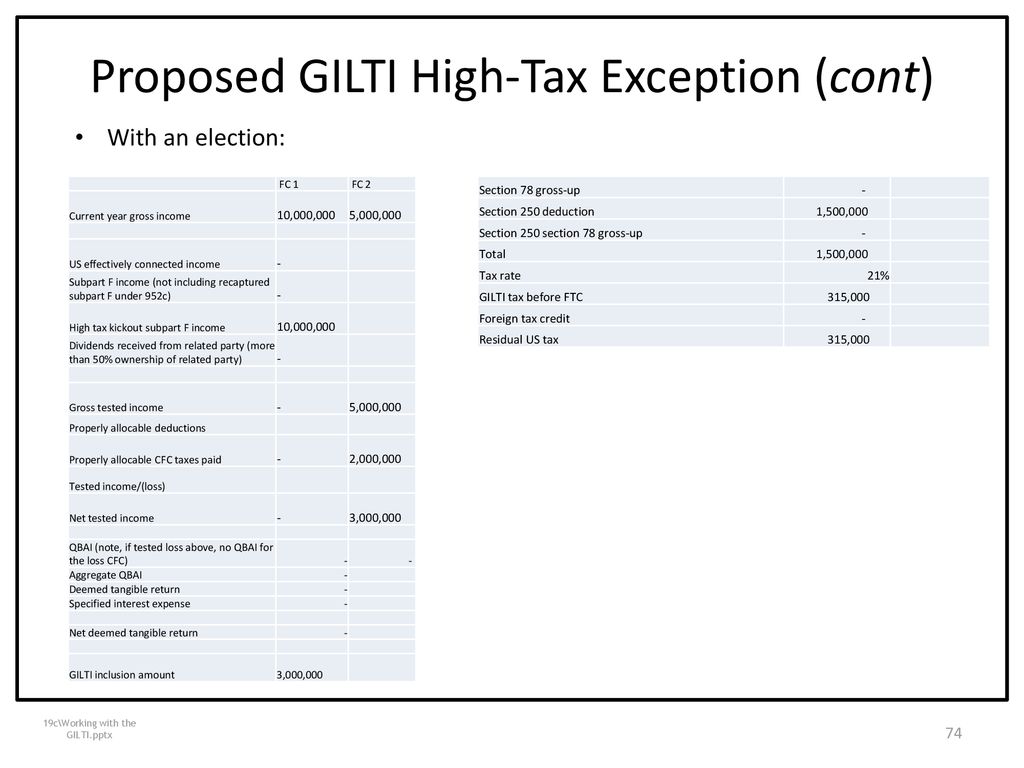

The fact that sales by CFCs generate tested income and tested income is generally assigned to the section 951A category might imply that RE expenditures should be allocated to the section 951A category. The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an effective rate greater than 189 90 of the highest US. Depending on fact pattern and the location of the tested unit a tax refund may be in the offing.

A fuller description of the property tax treatment of cell phone towers may be found in the enclosed OLR report 2001-R-0071. By submitting this form you confirm your consent to processing and accept the terms of our privacy policy. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a.

On July 20 the Internal Revenue Service IRS published final global intangible low-taxed income GILTI high-tax exception regulations TD. High-tax income the CFC grouping consistency rules etc should be like those in the Final GILTI High Tax Exception Regulations issued last July 2020. New Gilti Regulations will sometimes glitch and take you a long time to try different solutions.

Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the. Solar Water Heat Solar Space Heat Solar Thermal Process Heat Photovoltaics Landfill Gas Wind Biomass. There are significant differences between the final GILTI high-tax exception.

New Jersey offers different tax relief programs not only typical exemptions but also deductions of 250 and deferments or postponements of tax payments. This threshold is unchanged from the proposed regulations. Corporate tax rate which is 21.

In an interesting recent decision International Schools Services Inc. The effects of the Tax Cuts and Jobs Act TCJA on business expense deductions for meals and entertainmentIRS Issues. Incorporate the tested unit principles of the GILTI high-tax exclusion into the subpart F income high-tax exclusion.

The interaction of FTRs and the high-tax exception under GILTI and subpart F increases the importance of filing an origin year amended. The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an effective rate greater than 189 90 of the highest US. The final regulations on the GILTI high-tax exclusion mostly follow the 2019 proposed regulations REG-101828-19 but with some modifications.

The proposed regulations discussed below provide guidance conforming the Subpart F high-tax exception with the GILTI high-tax exclusion. The cell phone company is responsible for paying property tax on the antenna itself. LoginAsk is here to help you access New Gilti Regulations quickly and handle each specific case you encounter.

Thank you very much for downloading Final ExceptionMaybe you have knowledge that people have see numerous period for their favorite books taking into consideration this Final Exception but stop up in harmful downloads.

Klr Treasury Finalizes Gilti High Tax Exclusion

Gilti High Tax Exclusion Htj Tax

Final Regulations Clarify Potential Benefits Of The Gilti High Tax Exclusion Our Insights Plante Moran

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Gilti Tax On Owners Of Foreign Companies Expat Tax Professionals

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Klr Treasury Finalizes Gilti High Tax Exclusion

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

Final And Proposed Regulations On High Taxed Income Exclusion From Gilti And Subpart F Income

Harvard Yale Princeton Club Ppt Download

Guidance For Gilti High Tax Exception Forvis

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

The Verdict Is In The High Tax Exclusion Final Regulations Are Gilti Marcum Llp Accountants And Advisors

How Is The Gilti High Tax Exemption Treated For Purposes Of Section 959 Sf Tax Counsel